lincoln ne sales tax increase

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. This hotel is located in a city with a 175 city sales tax and in a county with a 4 county lodging tax.

You D Think 122 Million Would Buy You A Better Campaign Than This Infographics

2022 Nebraska Sales Tax Changes.

. The December 2020 total local sales tax rate was also 5500. There are sales tax rates for each state county and city here. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four.

Elections Neighborhood streets are focus of. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

What is omaha ne sales tax. There is no applicable county tax or special tax. YORK The citys sales tax receipts for the month of February came to the highest total for a.

Construction of four fire stations. Did South Dakota v. One will be a joint policefire station.

The Lincoln sales tax rate is. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax while the city of St. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent.

Replacement of the Citys emergency 911 radio system. 800-742-7474 NE and IA. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1.

The County sales tax rate is. Groceries are exempt from the Lincoln and Nebraska state sales taxes. Lincoln Ne Sales Tax Rate 2018.

The current total local sales tax rate in Lincoln County NE is 5500. The Nebraska state sales and use tax rate is 55 055. Lincoln Ne Sales Tax Rate Mei 15 2021.

Lincoln NE 68503 402 467-4321. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. More information for.

Lincoln ne sales tax increase Monday March 21 2022 Edit. There are no changes to local sales and. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. Over the past year there have been eighteen local sales tax rate changes in Nebraska.

Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019.

In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. Lincolns City sales and use tax rate will increase from 15 to 175 on October 1 2015. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

The Nebraska sales tax rate is currently. The official final results show 5065 percent of. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. What is the sales tax rate in Lincoln Nebraska. Wayfair Inc affect Nebraska.

For tax rates in other cities see Nebraska sales taxes by city and county. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective. 800-742-7474 NE and IA.

The Nebraska state sales and use tax rate is 55 055. Lincoln ne sales tax increase Monday March 21 2022 Edit. Raised from 55 to 725 Hershey Brady Maxwell Wellfleet and Dickens.

Lincolns City sales and use tax rate increase. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

You can print a 725 sales tax table here. PO Box 81869 Lincoln NE 68501. Lincoln voters approved the 14-cent increase in April to support two important public safety projects.

It was a close vote but. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. The Nebraska state sales and use tax rate is 55 055.

The city took in 38965023 for the general. Lincoln NE 68509. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1.

The Nebraska sales tax rate is currently. The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director. Nebraska sales tax changes effective July 1 2019.

The Lincoln Sales Tax is collected by the merchant on all qualifying sales made within Lincoln. The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1. The Nebraska state sales and use tax rate is 55 055.

A yes vote was a vote in favor of authorizing the. LINCOLN NE Americans for Prosperity-Nebraska today urged the Lincoln City Council to abandon Mayor Chris Beutlers proposal to include a 13 million annual sales tax. Fix Lincoln Streets Now the coalition supporting the proposed quarter-cent sales tax increase has raised more than 200000 primarily from.

1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public safety projects. 1 the Village of Orchard will start a 15 local sales and use tax.

States Are Imposing A Netflix And Spotify Tax To Raise Money

Electric Cars Near Me New Hybrids For Sale In Nebraska

States Are Imposing A Netflix And Spotify Tax To Raise Money

Honda Of Lincoln Honda Sales Service In Lincoln Ne

The Great Fake Child Sex Trafficking Epidemic The Atlantic

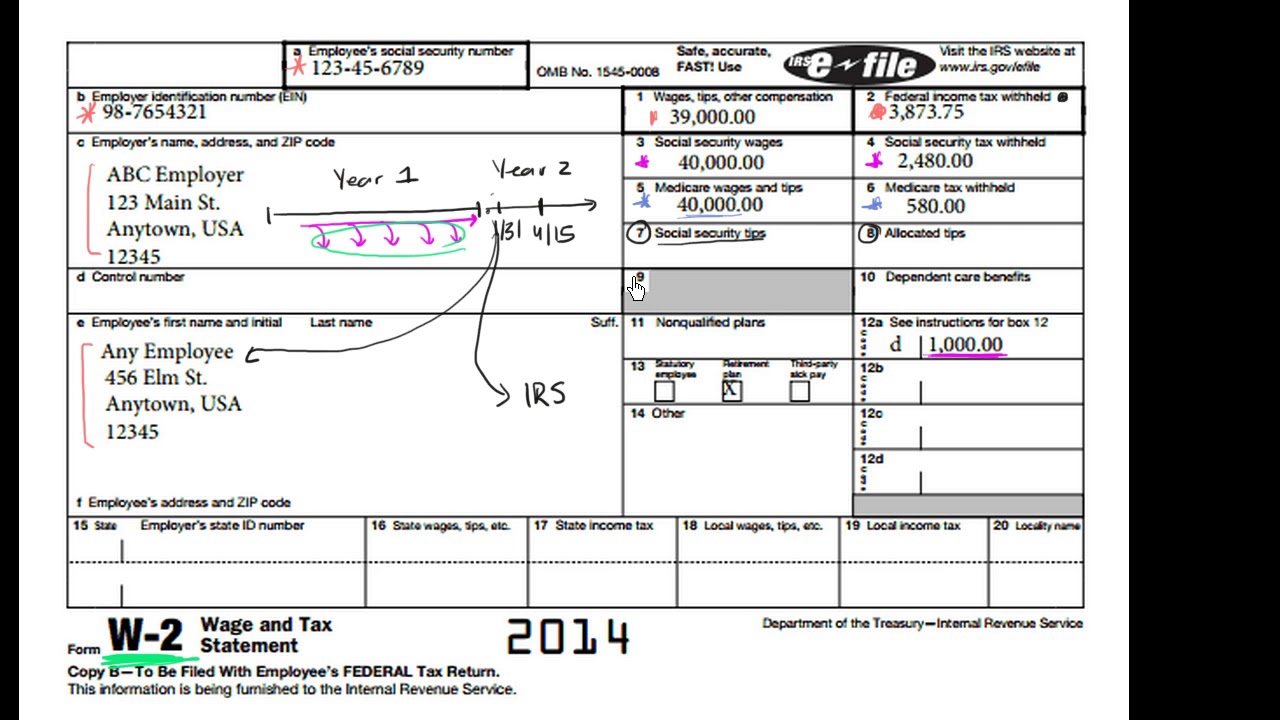

Intro To The W 2 Video Tax Forms Khan Academy

You D Think 122 Million Would Buy You A Better Campaign Than This Infographics

You D Think 122 Million Would Buy You A Better Campaign Than This Infographics

Home Foreclosure Legal Document With House Key In 2022 Foreclosures Foreclosure Help Foreclosure Listings

Current U S Drought Monitor Drought California Drought Map

North American Navion Piston Single Navi Aircraft Page 1 Flightaware

Ransomware Attack List And Alerts Cloudian

North American Navion Piston Single Navi Aircraft Page 1 Flightaware

You D Think 122 Million Would Buy You A Better Campaign Than This Infographics

Electric Cars Near Me New Hybrids For Sale In Nebraska